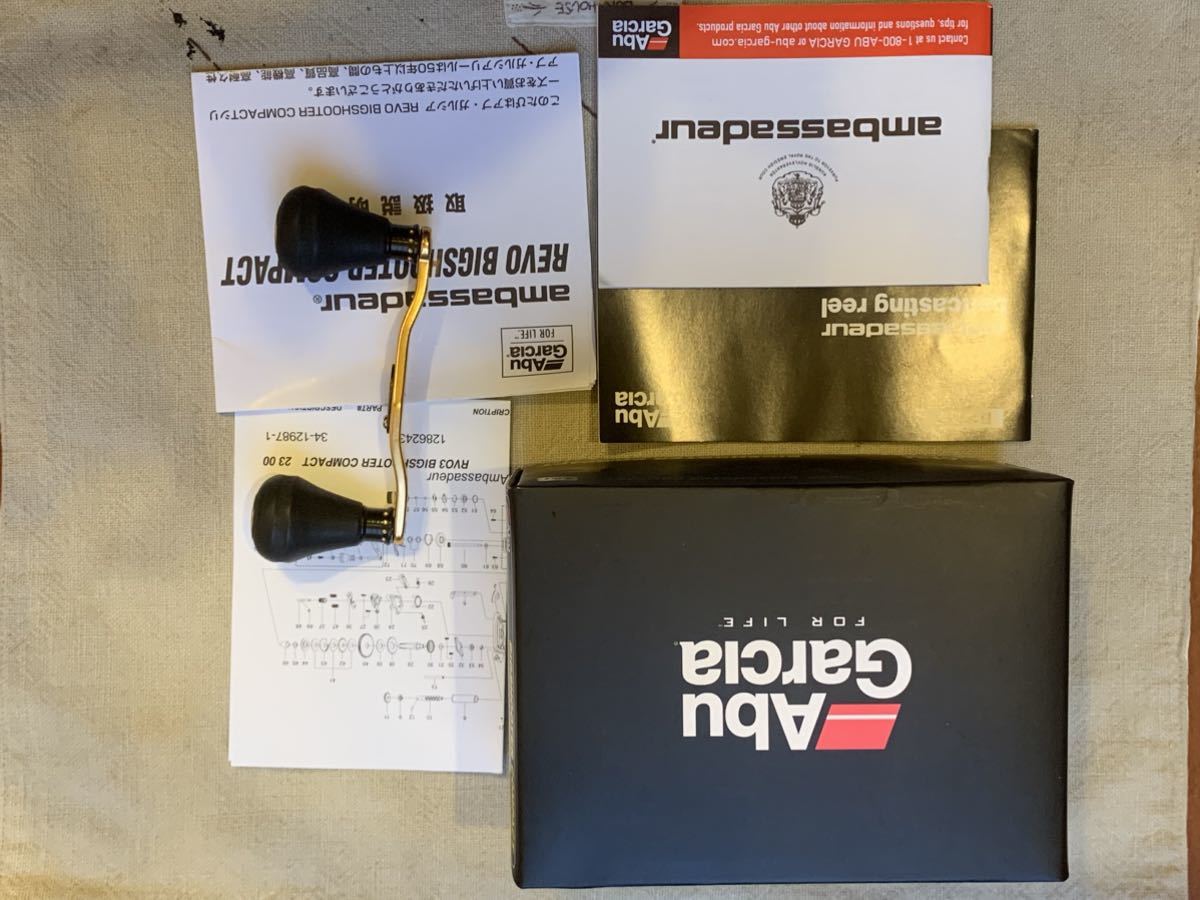

【美品】アブガルシア ビッグシューターコンパクト

(税込) 送料込み

商品の説明

アブガルシアのビッグシューターコンパクトです。

使用回数が少ないため傷が少なく、スプールの回転や巻き心地も良好です。

リール/パーツの種類···ベイトリール(両軸リール)

ハンドルの種類···右ハンドル(右巻き)商品の情報

| カテゴリー | スポーツ・レジャー > フィッシング > リール |

|---|---|

| ブランド | アブガルシア |

| 商品の状態 | 目立った傷や汚れなし |

REVO BIGSHOOTER COMPACT 8/7 (ビッグシューターコンパクト

REVO BIGSHOOTER COMPACT 8/7 (ビッグシューターコンパクト

数量限定人気 アブ ビッグシューターコンパクト 4TyLe-m68173343765

アブ・ガルシア(Abu Garcia) レボビッグシューターコンパクト( REVO

☆大感謝セール】 abugarcia ビッグシューターコンパクト 中古美品

国内外の人気が集結 【美品】アブガルシア REVO 左巻き 替えスプール

超美品再入荷品質至上! アブガルシア ビッグシューターコンパクト

素敵でユニークな アブガルシア ビックシューターコンパクト リール

オープニングセール】 アブガルシア ビッグシューターコンパクト中古品

国内外の人気が集結 【美品】アブガルシア REVO 左巻き 替えスプール

アブガルシア レボ ビックシューターコンパクト ベイトリール 美品

アブガルシア(Abu Garcia) レボ ビッグシューターコンパクト8-L(左

新型レボ ビッグシューターコンパクト8買ったが : つるつる宮古島

アブガルシア ビッグシューターコンパクト8 美品 opal.bo

高額売筋】 レボ アブガルシア 美品 (管66082) ビッグシューター

⑨アブガルシア レボ Newビッグシューターコンパクト8 比較的美品

モンスターとのパワーファイトに!「アブガルシア レボ NEWビッグ

絶品】 アブガルシア Revo4ビックシューターコンパクト8右巻き アブ

品多く 値下げ アブガルシア ビッグシューターコンパクト 超美品

REVO BIGSHOOTER COMPACT 8/7 (ビッグシューターコンパクト

国内外の人気が集結 【美品】アブガルシア REVO 左巻き 替えスプール

新品未使用 アブガルシア ビッグシューターコンパクト7 11309.42円

新品未使用 アブガルシア ビッグシューターコンパクト-

国内外の人気が集結 【美品】アブガルシア REVO 左巻き 替えスプール

数量限定人気 アブ ビッグシューターコンパクト 4TyLe-m68173343765

アブガルシア 現行モデル レボ ビッグシューターコンパクト8 美品 激安

☆大感謝セール】 abugarcia ビッグシューターコンパクト 中古美品

アブガルシア レボ ビッグシューターコンパクト 8-L | 中古釣具買取

☆大感謝セール】 abugarcia ビッグシューターコンパクト 中古美品

2023年最新】ビックシューターコンパクトの人気アイテム - メルカリ

アブガルシア レボ ビッグシューター コンパクト 8L/F249M 美品

国内外の人気が集結 【美品】アブガルシア REVO 左巻き 替えスプール

正規品 ヤフオク! - アブガルシアレボビックシューターコンパクト超

定番2023 ヤフオク! - アブガルシア REVO レボ ビッグシューターコンパ

REVO BIGSHOOTER COMPACT 8/7 (ビッグシューターコンパクト

A559 アブガルシア REVO ビッグシューターコンパクト ベイトリール

美品 アブガルシア REVO レボ ビッグシューターコンパクト|PayPayフリマ

アブガルシア(Abu Garcia) ベイトリール REVO ビッグシューター

☆大感謝セール】 abugarcia ビッグシューターコンパクト 中古美品

高品質 アブガルシア レボ ビッグシューターコンパクト8 比較的美品

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています