最終価格♡【廃盤品】スワロフスキー Carriage 18Kゴールドプレート

(税込) 送料込み

商品の説明

10年以上前に好きで集めていたスワロフスキー。

今は他のコレクションにハマっているので、まだまだ綺麗な状態のうちにお譲りしたいと思い出品します。

スワロフスキー「Travels through Time」シリーズより、 廃盤品 のひとつである名作『Carriage』。

物語に登場しそうな、どこかノスタルジックなデザインのこちらの作品は、子どものころに夢見ていた気持ちを思い起こさせます。

金属部分は18金ゴールドコーティングを施しており、細工が非常に美しく、滑らかな曲線がエレガントで巧みな技が光る一品です。

前輪:左右に90度可動/前輪後輪ともに回転。

廃盤品なので、コレクターの方も是非♡

サイズ: 5.5 x 7.5 cm

素材...クリスタル

テイスト...アンティーク・クラシック, エレガント商品の情報

| カテゴリー | インテリア・住まい・小物 > インテリア小物 > 置物 |

|---|---|

| ブランド | スワロフスキー |

| 商品の状態 | 目立った傷や汚れなし |

国内発送】 【新品】スワロフスキー ハローキティ その他

年末のプロモーション特価!-Vivienne Westwood - ヴ•ィヴィアン

スワロフスキー置物・アクセサリー専門店 ☆プラネタリウム☆

最大80%オフ! イルカモチーフのペンダントトップ PT 天然イエロー

新品 WORLD OF FLIGHT JORDAN ノベルティ ステンレスマグ - 食器

スワロフスキー置物・アクセサリー専門店 ☆プラネタリウム☆

【国内発送】 【新品】スワロフスキー ハローキティ その他

年末のプロモーション特価!-Vivienne Westwood - ヴ•ィヴィアン

スワロフスキー置物・アクセサリー専門店 ☆プラネタリウム☆

最大80%オフ! イルカモチーフのペンダントトップ PT 天然イエロー

ORIENT - ORIENT アナログ腕時計の通販 by サエshop|オリエントならラクマ

ORIENT - ORIENT アナログ腕時計の通販 by サエshop|オリエントならラクマ

Plage chain サスペンダー プラージュ-

年末のプロモーション特価!-Vivienne Westwood - ヴ•ィヴィアン

大好き 無印良品 スタッキングシェルフセット・3段×2列・オーク材 棚

最大80%オフ! イルカモチーフのペンダントトップ PT 天然イエロー

ORIENT - ORIENT アナログ腕時計の通販 by サエshop|オリエントならラクマ

矢沢あい 6作品 全巻 49冊セット 全巻セット-

使い勝手の良い】 良品✨プラダ カメラバッグ 三角プレート ナイロン

スズキ イナズマ400 ローン可 カスタム車 SUZUKI ETC 車検残有 400cc

グリッター チャージャープレート 33cm ニューゴールド&クリア

SYMPATHY OF SOUL(シンパシーオブソウル) Large Horseshoe Pendant w

ONE STYLE by BRING クロムハーツ・ゴローズの買取・販売・通販専門店

トゥー プライ 589 ポラリス ゴールド チャーム 18金 ペンダントトップ

日本最大のブランド ジュエリーマキ K18 サファイヤ0.34ct リング 11号

SYMPATHY OF SOUL(シンパシーオブソウル) Sun Plate Pendant

アズワン AS ONE 引き戸仕様 SLA-1500R 品番 サイド実験台

ONE STYLE by BRING クロムハーツ・ゴローズの買取・販売・通販専門店

グリッター チャージャープレート 33cm ニューゴールド&クリア

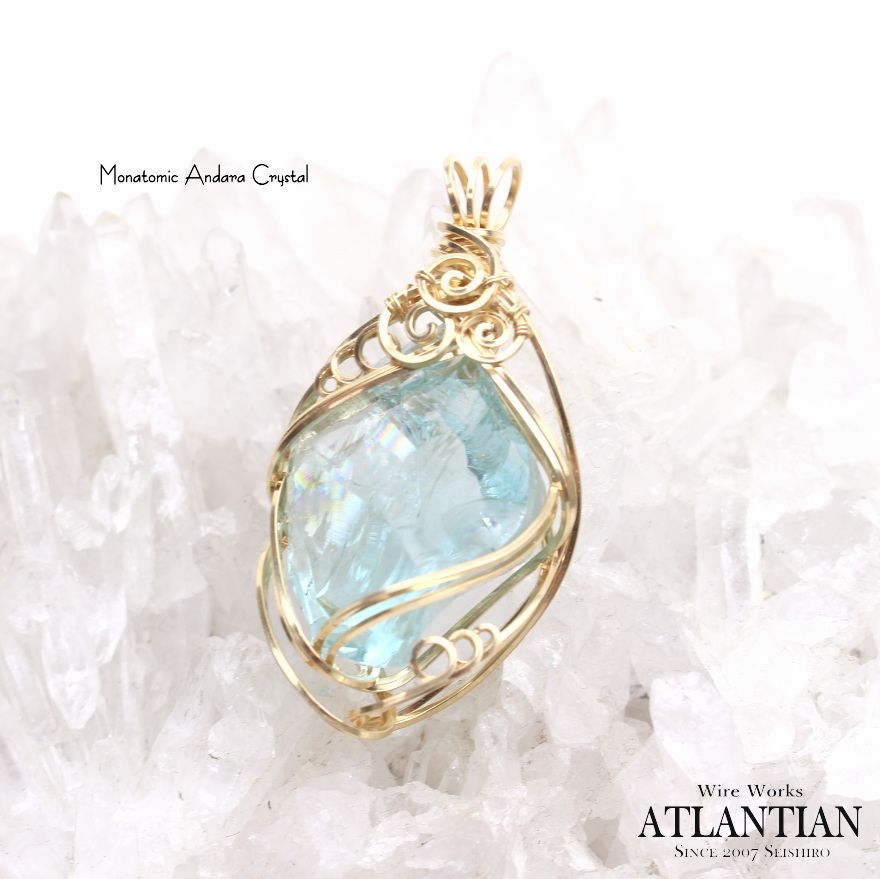

アンダラアクアセレニティーとクロスのペンダント

Plage chain サスペンダー プラージュ-

SYMPATHY OF SOUL(シンパシーオブソウル) K18Yellow Gold 0.7 Square

ONE STYLE by BRING クロムハーツ・ゴローズの買取・販売・通販専門店

一番くじ ジョジョの奇妙な冒険 ストーンオーシャン 上位賞コンプ-

KRONE/クローネ プリマヴェーラ』K18ピンクゴールド エンゲージリング

アンダラアクアセレニティーとクロスのペンダント

グリッター チャージャープレート 33cm ニューゴールド&クリア

最新発見 美品✨COACH ネイビー チャーリー バックパック

ONE STYLE by BRING クロムハーツ・ゴローズの買取・販売・通販専門店

五等分の花嫁 コラボアパレル 中野四葉 ブルゾン-

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています