asics tokyo 陸上 スパイク 中距離 長距離

(税込) 送料込み

商品の説明

大会で1回使用しました。自分の走り方に合ってなく使いこなせないので、出品します。

状態はとても良く、大きな汚れ、プレートの割れはございません。状態は全く使ってなかったので綺麗です。まだまだ使えます。中長距離推奨です。

定価20,で購入しました。

サイズ···26.5~27.0cm商品の情報

| カテゴリー | スポーツ・レジャー > その他スポーツ > 陸上競技 |

|---|---|

| ブランド | アシックス |

| 商品の状態 | 未使用に近い |

アシックス asics COSMORACER LD 2 TOKYO 陸上スパイク 長距離用

株式会社アシックス プレスリリース

METASPEED LD LE | DIVA PINK/WHITE | メンズ 陸上競技 シューズ

アシックス asics COSMORACER LD 2 TOKYO 陸上スパイク 長距離用

アシックス 陸上 スパイク 中・長距離 障害 ガンラップ2 1093A131 702

アシックス asics コスモレーサー LD3 1093A196-702 ユニセックス 陸上 スパイク 中長距離専用 3,000~10,000m-ウシダスポーツ

アシックス asics COSMORACER LD 2 TOKYO 陸上スパイク 長距離用

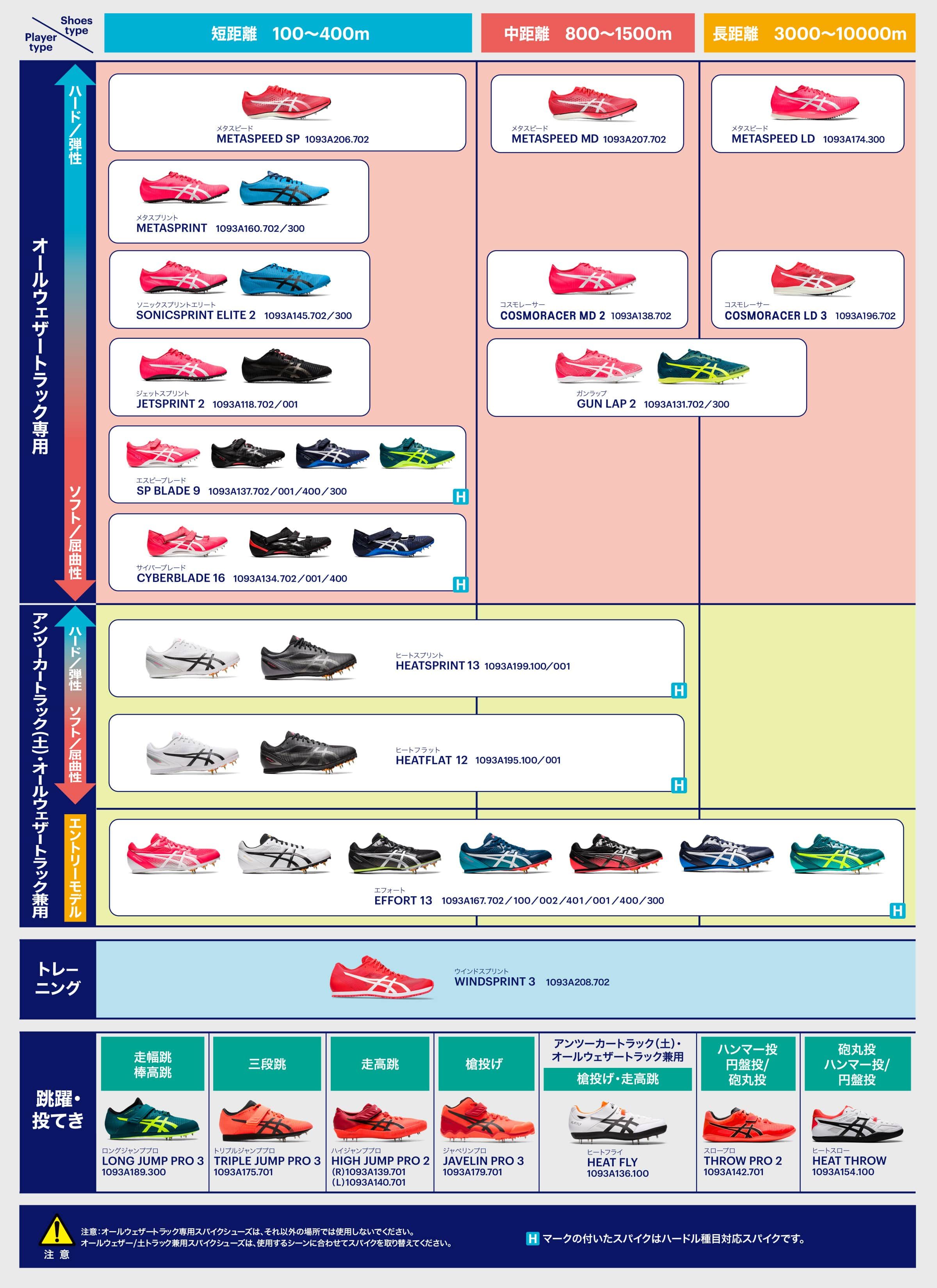

陸上競技 スパイク & 陸上 ユニフォーム|アシックス公式

アシックス 陸上スパイク 中・長距離 ハイパー LD 6 1093A089

陸上競技 スパイク & 陸上 ユニフォーム|アシックス公式

株式会社アシックス プレスリリース

アシックス(ASICS)(メンズ、レディース)陸上スパイク 長距離

陸上競技 スパイク & 陸上 ユニフォーム|アシックス公式

ランニング,陸上スパイク,中・長距離のアシックス asics 陸上 メンズ

AthletePit アスリートピット

アシックス asics COSMORACER LD 3 (コスモレーサー) 陸上スパイク 中長距離専用 (3000m~10000m ハードル) 23FW (1093A196-702)

アシックス asics COSMORACER LD 2 TOKYO 陸上スパイク 長距離用

ランニング,陸上スパイク,中・長距離のアシックス asics GUN LAP 2

中長距離スパイクレビュー【2021年編】と数社の中長距離プロトスパイク

アシックス(ASICS)(メンズ、レディース)陸上スパイク 中・長距離

陸上競技 スパイク & 陸上 ユニフォーム|アシックス公式

アシックスから、ピンレスカーボンプレートを採用の長距離トラック競技

楽天市場】COSMORACER LD 2 (コスモレーサー エルディー 2)【asics

アシックス 陸上スパイク 中長距離用 LD JAPAN TTP503 27.0㎝ - 陸上競技

ASICSの〝先進的〟レーシングシューズ METASPRINT(メタスプリント

部活生応援!はじめての陸上競技・陸上スパイクの選び方|アシックス公式

各社の2022年中長距離プロトスパイク+α|Sushiman 🇯🇵

アシックス 中距離用 陸上スパイク - www.fourthquadrant.in

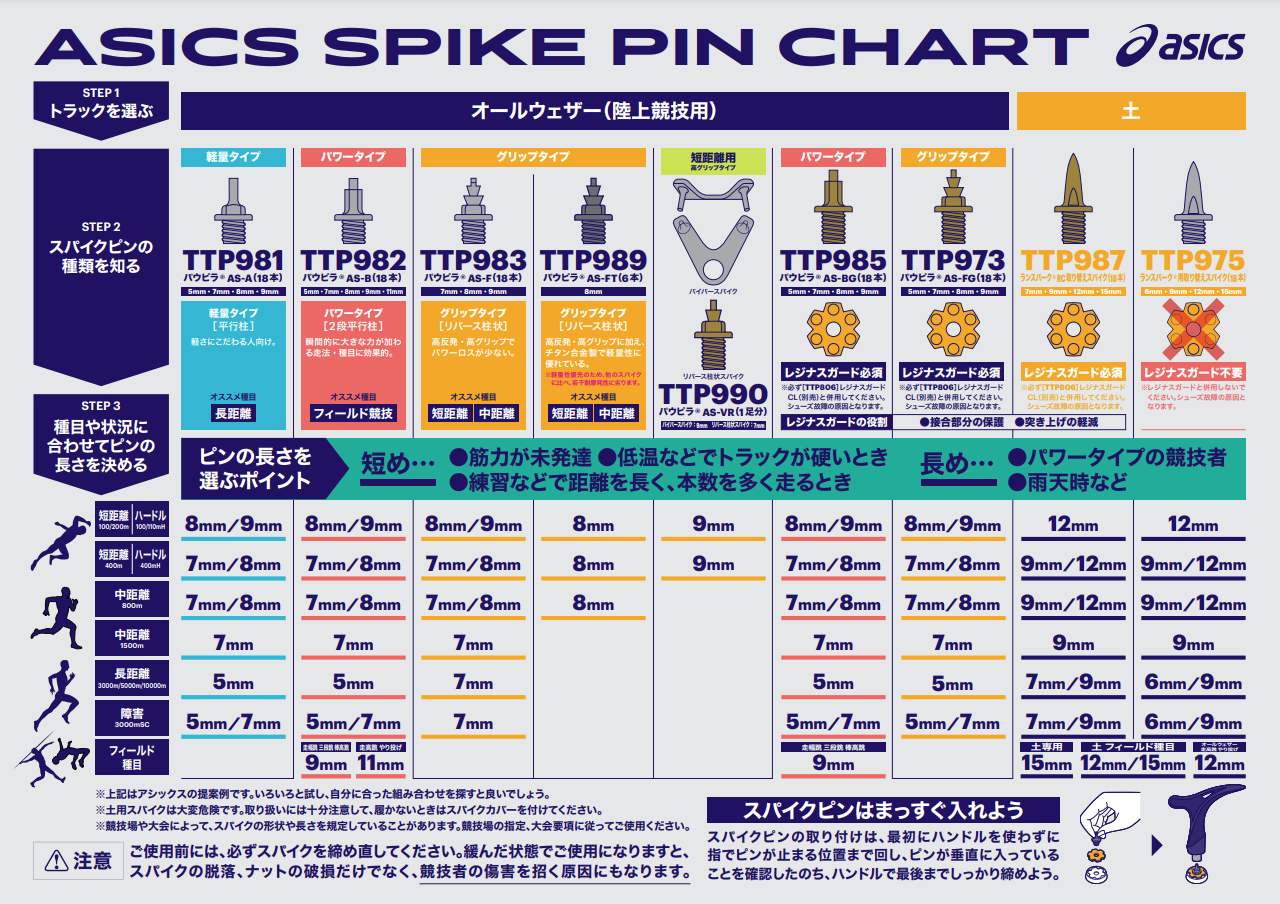

陸上競技スパイクピン チャート表 | アシックス - ASICS

2023年秋冬 asics アシックス 陸上スパイク コスモレーサーLD 3 中距離 長距離用 オールウェザー専用 1093A196-702-クレブネット|xraebnet.com|オンラインショップ

COSMORACER LD 2 | DIVA PINK/WHITE | メンズ 陸上競技 シューズ

陸上競技 スパイク & 陸上 ユニフォーム|アシックス公式

アシックス asics COSMORACER LD 2 TOKYO 陸上スパイク 長距離用

ランニング,陸上スパイク,中・長距離の【即出荷】コスモレーサーMD 2

2022年最新!中長距離用陸上スパイク全集 | 陸上探題

陸上競技 スパイク & 陸上 ユニフォーム|アシックス公式

楽天市場】アシックス asics METASPEED LD LE 陸上スパイク (長距離

COSMORACER LD 2 TOKYO ASICS 陸上スパイク 長距離用 オールウェザー

陸上競技 スパイク & 陸上 ユニフォーム|アシックス公式

ランニング,陸上スパイク,中・長距離のアシックス asics 陸上 メンズ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています