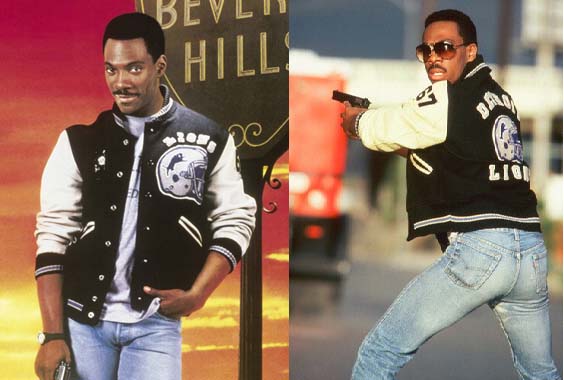

デトロイト ライオンズ スタジャン

(税込) 送料込み

商品の説明

ビバリーヒルズコップ!

以前知人から譲ってもらいました。

気に入っているため、

正直、出品を取り消すかもしれません。。商品の情報

| カテゴリー | メンズ > ジャケット/アウター > スタジャン |

|---|---|

| 商品のサイズ | S |

| 商品の状態 | 傷や汚れあり |

デトロイト ライオンズ スタジャン-hybridautomotive.com

2023年最新】デトロイトライオンズ スタジャンの人気アイテム - メルカリ

NFL DETROIT LIONS VINTAGE DEADSTOCK SNAPBACK CAP SPORTS

デトロイトライオンズ スタジャン | labiela.com

定番人気格安】 ビバリーヒルズコップ デトロイト・ライオンズ

レア】NFL スタジャン xxl DETROIT LIONS 割引済 smcint.com

特別セーフ ビバリーヒルズコップ Lサイズ デトロイト・ライオンズ

ビバリーヒルズコップ“デトロイト・ライオンズ“袖革スタジャンMサイズ

デトロイトライオンズ スタジャン XS ビバリーヒルズコップ エディ

超歓迎された ⭐️限界価格⭐️PUMA NFL 90's 中綿ベンチコート

全国無料定番 NFL スターター 90s ダラス カウボーイズ スタジャン USA

定番人気格安】 ビバリーヒルズコップ デトロイト・ライオンズ

ビバリーヒルズコップ“デトロイト・ライオンズ“袖革スタジャンMサイズ

定番人気格安】 ビバリーヒルズコップ デトロイト・ライオンズ

中古・古着通販】NFL (ナショナル・フットボール・リーグ) 90'sレザー

ヴィンテージ古着】RED SKINS/ワシントン・コマンダース NFL フェイク

スターター NFL 90年代 デッドストック デトロイト ライオンズ

楽天市場】NFL パッカーズ スタジャン スーパーボウル優勝記念 Super

通販 人気】 90s USA製 ビンテージ L ジャケット アワード スタジャン

ジャケット スタジャン 【ヴィンテージ古着】90's STARTER

NFL デトロイトライオンズ スタジャン ビバリーヒルズコップ 革(S

レア】NFL スタジャン xxl DETROIT LIONS 割引済 smcint.com

ビバリーヒルズコップ“デトロイト・ライオンズ“袖革スタジャンMサイズ

VENOM2 ヴェノム2 エディ・ブロック着 DETROIT LIONS デトロイト

スターター NFL 90年代 デッドストック デトロイト ライオンズ

jhDesign NFL ALL OVER PATCH ツイル ジャケット アメフト ロゴ 総柄

2023年最新】デトロイトライオンズ スタジャンの人気アイテム - メルカリ

Amazon.co.jp: NFL スタジャン レッドスキンズ G-III マルーン

Lee(WAIPER)|AVIREXのスタジャンを使ったコーディネート - WEAR

NFL デトロイト・ライオンズ スタジャン ビバリーヒルズコップの落札

デトロイト ライオンズ スタジャン 減額

ビバリーヒルズコップ“デトロイト・ライオンズ“袖革スタジャンMサイズ

NFL デトロイト・ライオンズ ナイロン スタジャン パーカー 中綿 ロゴ

ビバリーヒルズコップ デトロイト・ライオンズスタジャン Lサイズの

NFLデトロイト・ライオンズのスタジャン:検スーパーボウル49ers(ウエア

待望☆】 レアスターター製デトロイトライオンズのスタジャン

ビッグサイズ NFL シーホークス SEAHAWKS 刺繍 フェイクレザー

スタジャン/デトロイトライオンズ/38/ウール/NVY

超特価SALE開催! DOLPHINS グリーン ジャケット ドルフィンズ サテン

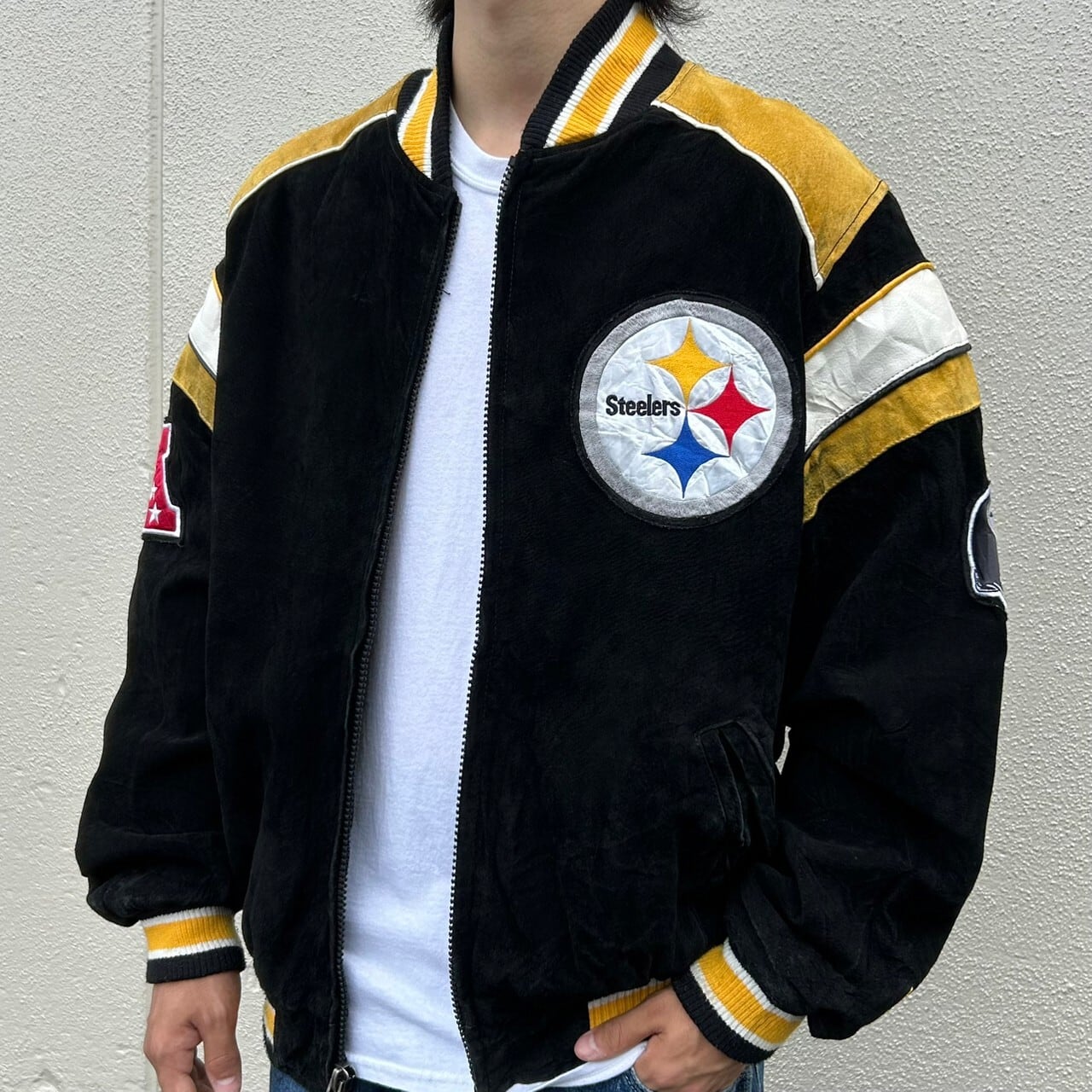

NFL スティーラーズ カールバンクス レザージャケット スタジャン S

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています