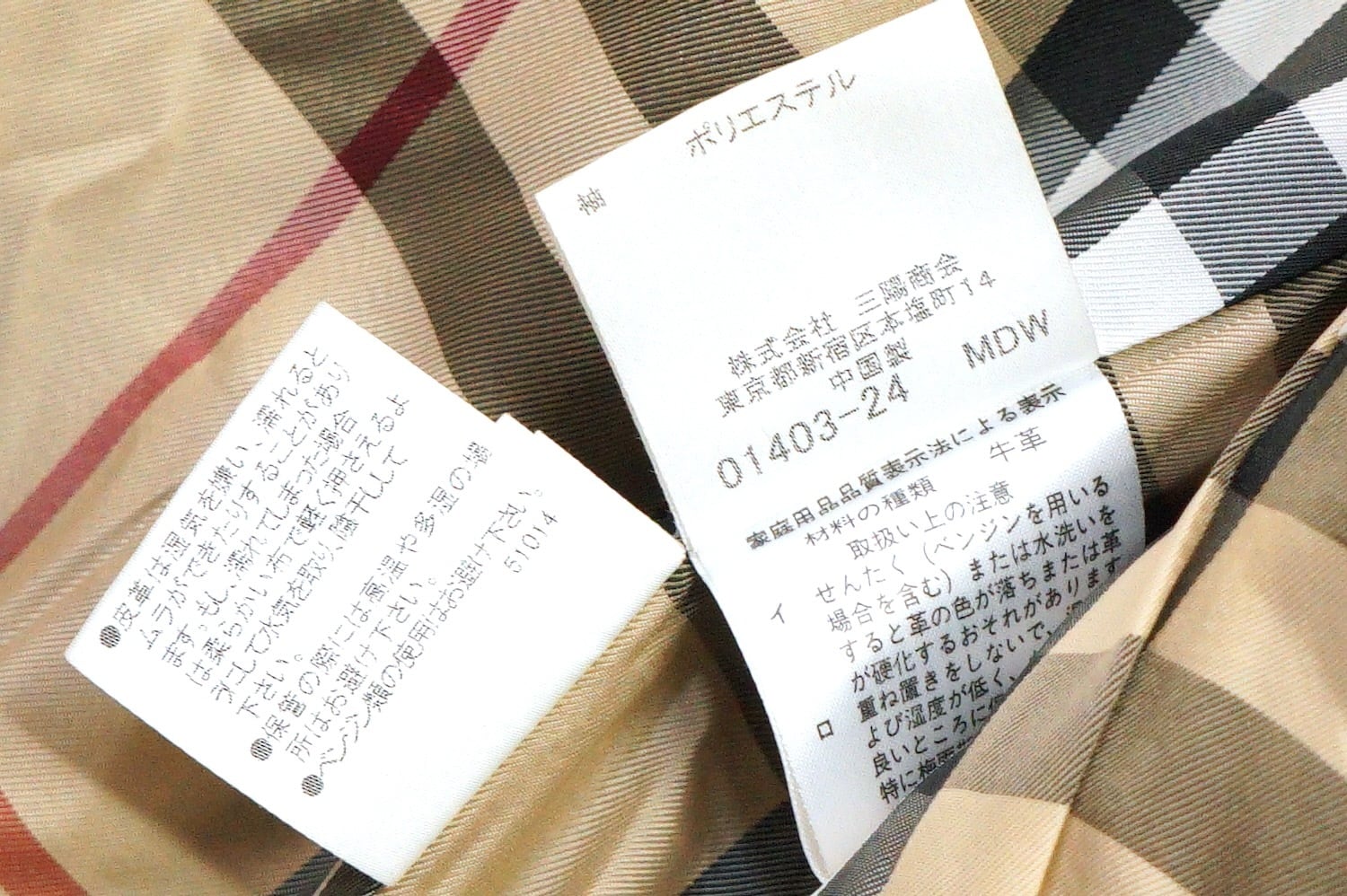

バーバリー2枚重ねハーフコート

(税込) 送料込み

商品の説明

袖丈...長袖

中…黒地キルトとチェック

外…ベージュ

両サイドファスナーにて取り外し可能商品の情報

| カテゴリー | メンズ > トップス > その他 |

|---|---|

| 商品のサイズ | L |

| ブランド | バーバリーロンドン |

| 商品の状態 | 目立った傷や汚れなし |

総合福袋 バーバリー2枚重ねハーフコート その他 - topnetservices.com.br

バーバリー コート ハーフコート ジップアップ 裏チェック ライナー付 コットン

BURBERRY BLACK LABEL - Vintage バーバリー Burberrys コート ハーフ

バーバリーロンドン ハーフコート ジャケット ノバチェック メガチェック

バーバリーのコート!メンズに人気の長く使える春アウターのおすすめ

バーバリー コート ハーフコート ジップアップ 裏チェック ライナー付 コットン

超特価sale開催】 808 ノバチェック バーバリーズ トレンチコート

BURBERRY BLACK LABEL - Vintage バーバリー Burberrys コート ハーフ

バーバリーが描く自由で境界のない美しい世界へ。|ファッション

BURBERRY - バーバリー 2枚襟 トレンチコート ライナー付き 綿100

バーバリー イングランド製 一枚袖タイプ ハーフコート バーバリー

1枚袖のステンカラーコートは如何ですか。 | SECOURSのブログ

ヤフオク! - バーバリー ロンドン アウター ハーフコート ロングカーデ...

新品】 ハーフコート XS バーバリーブリット y-000803 BURBERRY BRIT

長く愛せる“トレンチコート”の中で、知っておくべき名品とその理由

バーバリーハーフコートMサイズベージュ | labiela.com

バーバリーロンドン ハーフコート ジャケット ノバチェック メガチェック

2050 BURBERRY LONDON BLUE LABEL バーバリー レザーコート トレンチ

楽天市場】イングランド製 □ BURBERRY LONDON バーバリー 中綿

BURBERRY BLACK LABEL - Vintage バーバリー Burberrys コート ハーフ

ダッフルコートのおすすめブランド20選。おしゃれなメンズコーデもご紹介

バーバリー イングランド製 一枚袖タイプ ハーフコート バーバリー

バーバリーのコート!メンズに人気の長く使える春アウターのおすすめ

バーバリーが描く自由で境界のない美しい世界へ。|ファッション

バーバリーロンドン ハーフコート ジャケット ノバチェック メガチェック

楽天市場】イングランド製 □ BURBERRY LONDON バーバリー 中綿

バーバリー イングランド製 一枚袖タイプ ハーフコート バーバリー

バーバリー重ね着風トレーナー 日本最級 1620円 pac.pe

バーバリー イングランド製 一枚袖タイプ ハーフコート バーバリー

新品未使用品タグ付き バーバリーハーフコート ベージュ UK50 L 22万

楽天市場】イングランド製 □ バーバリー ロンドン ウール ダッフル

バーバリーロンドン ダウンジャケット ハーフコート フード付き | ビー

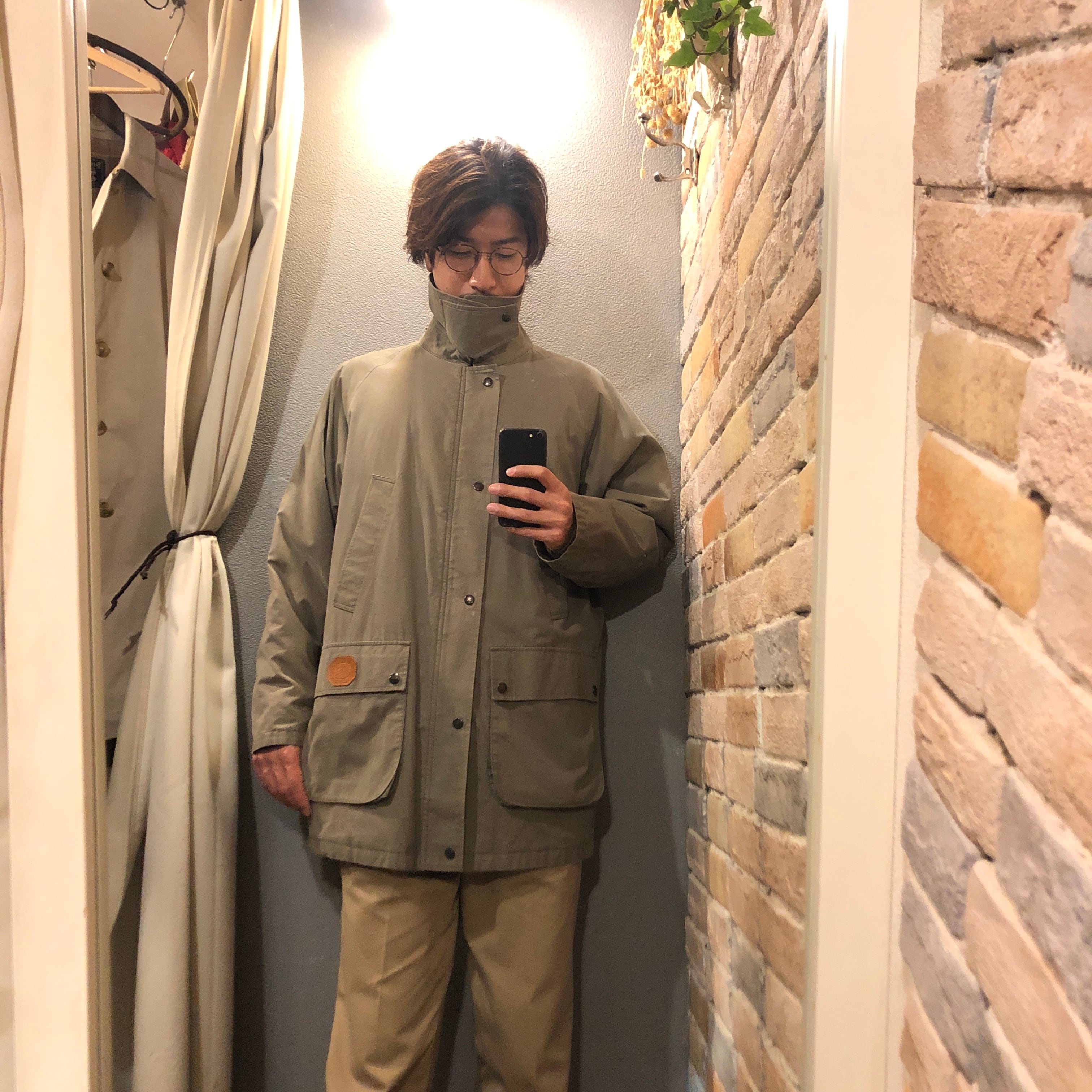

![BURBERRY[バーバリー] | 90s 裏地 ノバチェック コットン ギャバジン](https://boo-bee-2.s3-ap-northeast-1.amazonaws.com/upload/save_image/10251945_6538f1c6605e2.jpg)

BURBERRY[バーバリー] | 90s 裏地 ノバチェック コットン ギャバジン

パーカー メンズ ジップアップ おしゃれ コーデ 人気 ブランド

ハラちゃんの知らない世界33☆ Burberrys ☆ 一枚袖 ☆BLACK

ヤフオク! - BURBERRY バーバリー ハーフコート ノバチェック

バーバリー コート ハーフコート ジップアップ 裏チェック ライナー付 コットン

バーバリーハーフコートMサイズベージュ | labiela.com

楽天市場】イングランド製 □ バーバリー ロンドン ウール ダッフル

ダッフルコートのおすすめブランド20選。おしゃれなメンズコーデもご紹介

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています