ジェフハミルトン レイカーズ リバーシブル スタジャン ブルゾン 2XL

(税込) 送料込み

商品の説明

ブランド名:JH Design Groupジェフハミルトン

サイズ:2XL

肩幅:約60cm 身幅:約70cm 着丈:約78cm 袖丈:約64cm

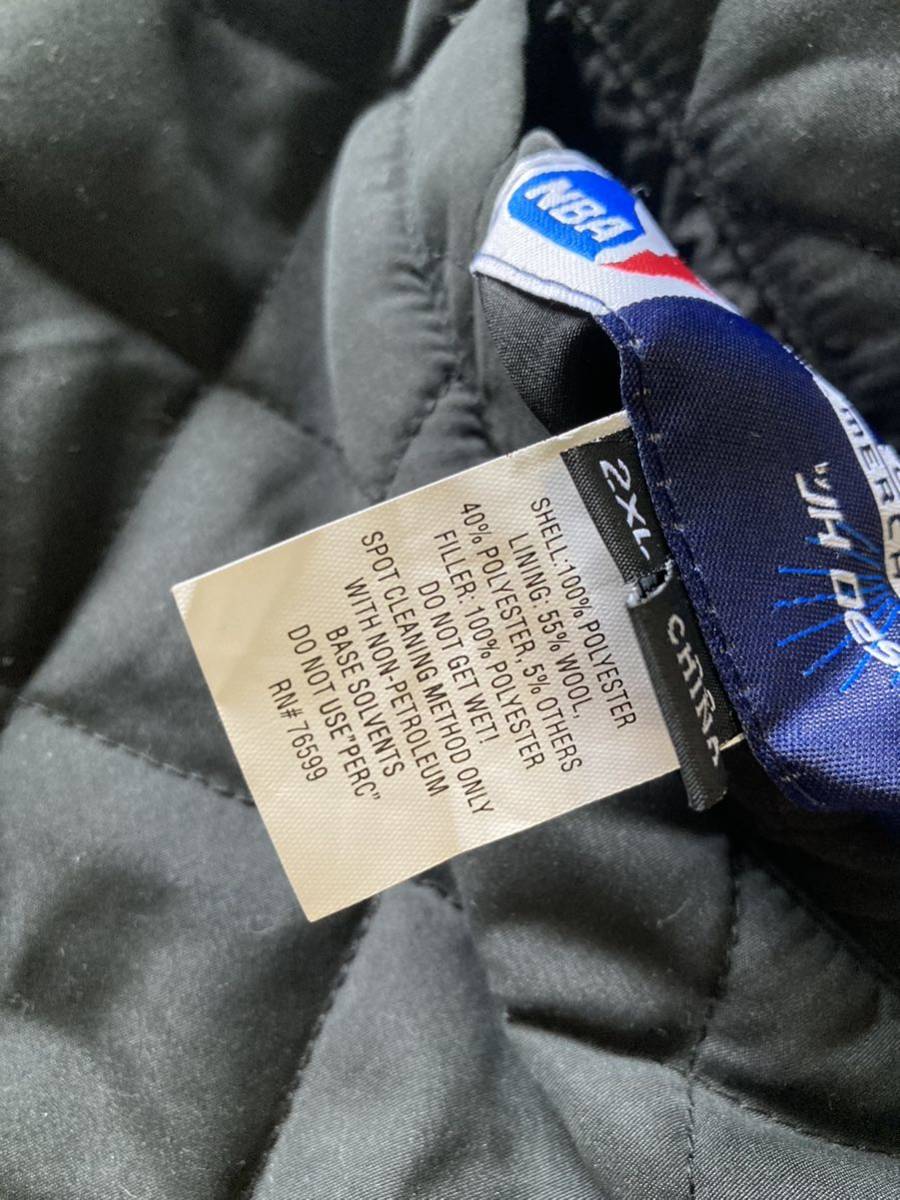

素材 内タグ参照

色:ブラック

状態:画像にありますようにキルティング側に少しヨゴレがありますが特に目立つダメージなく問題なく着用していただけます。

AACD加盟店での購入となります、確実正規品ですので、ご安心ください。商品の情報

| カテゴリー | メンズ > ジャケット/アウター > スタジャン |

|---|---|

| 商品のサイズ | 2XL(3L) |

| 商品の状態 | 目立った傷や汚れなし |

ジェフハミルトン レイカーズ リバーシブル スタジャン ブルゾン 2XL | フリマアプリ ラクマ

JH Design Group ジェフハミルトン レイカーズ リバーシブル スタジャン ブルゾン ジャケット 2XL ダブルフェイス 八村塁

ジェフハミルトン レイカーズ リバーシブル スタジャン ブルゾン 2XL

激安通販の 本革 90s ジェフハミルトン レイカーズ リバーシブル

ジェフハミルトン レイカーズ リバーシブル スタジャン ブルゾン 2XLの

JH Design Group ジェフハミルトン レイカーズ リバーシブル スタジャン ブルゾン ジャケット 2XL ダブルフェイス 八村塁

本革 90s ジェフハミルトン レイカーズ リバーシブルスタジャン 2XL-

本革 90s ジェフハミルトン レイカーズ リバーシブルスタジャン 2XL-

本革 90s ジェフハミルトン レイカーズ リバーシブルスタジャン 2XL-

ジェフハミルトン製 レイカーズ 袖革 スタジャン-

ジェフハミルトン レイカーズスタジャン | settannimacchineagricole.it

ジェフハミルトン製 レイカーズ 袖革 スタジャン-

ジェフハミルトン レイカーズ リバーシブル スタジャン ブルゾン 2XLの

送料込】 ジェフハミルトン jeff hamilton レイカーズ エアジョーダン

ネット売り MLB ヤンキース スタジャン リバーシブル ジェフハミルトン

ジェフハミルトン レイカーズ リバーシブル スタジャン ブルゾン 2XLの

ジェフハミルトン レイカーズ リバーシブル スタジャン ブルゾン 2XLの

90s USA製 ジェフハミルトン NFL スタジャン XL レッドスキンズ

ジェフハミルトン レイカーズ リバーシブル スタジャン ブルゾン 2XLの

開店記念セール!】 超希少 ジェフハミルトン リバーシブル スタジャン

珍しい ジェフハミルトン jeff レイカーズ デッドストック nba

レイカーズ スタジャンの値段と価格推移は?|8件の売買データから

ハミルトン スタジャンの通販 200点以上 | フリマアプリ ラクマ

新品入荷 Jh 訳あり design M スタジャン リバーシブル ジェフ

超特価激安 超希少【全刺繍】NBA JH DESIGN ジェフハミルトン マイアミ

ジェフハミルトン レイカーズスタジャン | labiela.com

80s 90s USA製ジェフハミルトン FALCONS スタジャン 袖レザー-

ジェフハミルトン製 レイカーズ 袖革 スタジャン-

いいスタイル JEFF HAMILTON ジェフハミルトン スタジャン NBA

auctions.c.yimg.jp/images.auctions.yahoo.co.jp/ima...

レトロ リバーシブル スタジャン ブルゾン古着usedAS56 - 通販

売れ筋ランキングも掲載中! スタジャン 袖革 ブルネロクチネリ 【定価

2023年最新】ヤフオク! -ジェフハミルトンの中古品・新品・未使用品一覧

ハミルトン スタジャンの通販 200点以上 | フリマアプリ ラクマ

春夏新作 ジェフ・ハミルトン ニューヨーク・ヤンキース スタジャン

JEFF HAMILTONの値段と価格推移は?|21件の売買データからJEFF

2023年最新】ヤフオク! -ジェフハミルトン(スタジアムジャンパー)の

本店激レア 美品 ジェフハミルトン スタジャン ブルゾン スーパー

NBAレイカーズ ジェフハミルトン スタジャン リバーシブル 90s|PayPay

ハミルトン スタジャンの通販 200点以上 | フリマアプリ ラクマ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています