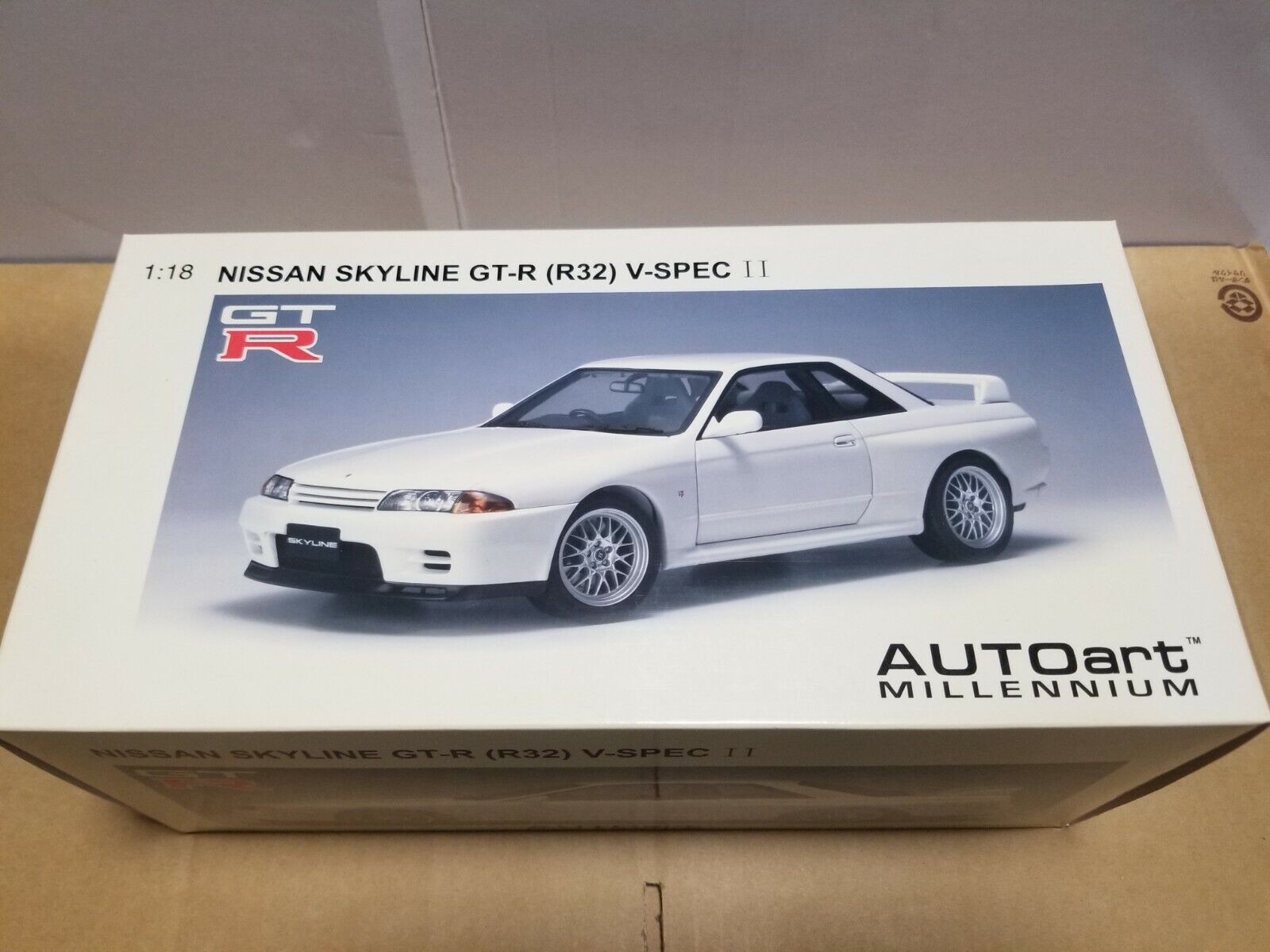

R32スカイラインGT-R VスペックⅡ 1/18モデル

(税込) 送料込み

商品の説明

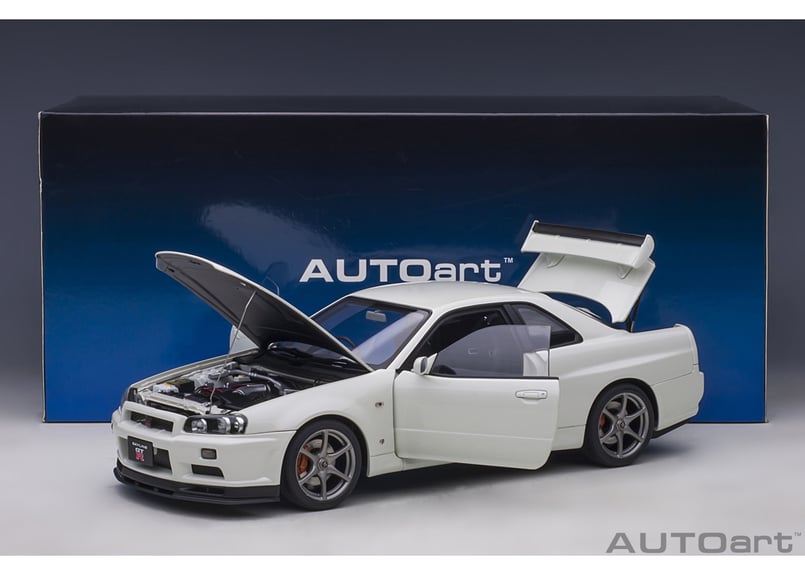

オートアート制作のR32GT-R

VスペックⅡの1/18モデルです。

古いモデルですが、とても綺麗に保たれていると思います

RB26DETTエンジン巧妙に再現されていて更にBBSのアルミホイールもすばらしいと思えます。

コレクション整理のため出品致します 大事にしてくださる方ぜひどうでしょうか?

オートアート

京商

BBR

ミニチャンプス

メイクアップ商品の情報

| カテゴリー | おもちゃ・ホビー・グッズ > おもちゃ > ミニカー |

|---|---|

| ブランド | オートアート |

| 商品の状態 | 目立った傷や汚れなし |

Autoart 1:18 Nissan Gtr R32 Skyline V-Spec II Simulation Model Car

1/18 AUTOart NISSAN SKYLINE GTR GT-R (R32) V-SPEC II TUNED VERSION (GUN GREY METALLIC) Diecast Car Model 77417

1/18 AUTOart Nissan Skyline GT-R GTR (R32) V-SPEC II Tuned Version (Crystal White) Car Model

1:18 Nissan Skyline GTR R32 V-Spec II Crystal White By Kyosho ( 08365W )

Initial D

Autoart 77345 NISSAN SKYLINE GT-R R32 V-SPEC II 2 CRYSTAL WHITE 1/18

R32スカイラインGT-R VスペックⅡ 1/18モデル - ミニカー

Skyline GT-R (R34) V-Spec II RHD (Right Hand Drive) Black Pearl 1/18 Model Car by Autoart 77407

TAMIYA Nissan Skyline GT-R R34 V-Spec II 1/24 Scale Model Kit 24258

1:18 Nissan Skyline GTR R32 V-Spec II Crystal White By Kyosho ( 08365W )

NISSAN - SKYLINE GT-R (R32) V-SPEC II TUNING VERSION 1991

-v-spec-ii-tuned-version-1-az__63858.1642177870.jpg)

Nissan Skyline GT-R (R32) V-Spec II Tuned Version, Blue - AUTOart 77415 - 1/18 Scale Diecast Model Toy Car

NISSAN - SKYLINE GT-R (R32) V-SPEC II TUNED VERSION 1991

AUTOart 1/18 日産 スカイライン GT-R (R34) Vスペック II (ホワイ...

1/18 AUTOart NISSAN SKYLINE GT-R GTR (R32) V-SPEC II TUNED VERSION

1/18 Nissan Skyline GT-R(R32)V-SPEC II Autoart 77415 Blue Model

Nissan Skyline GT-R (R34) V-SPEC II N1 RHD (Right Hand Drive) White with Carbon Hood 1/64 Diecast Model Car by Inno Models

AUTOart New Nissan Skyline GT-R (R34) V-Spec II Nür w/ BBS

AUTOart オートアート 38526 1/18 日産 スカイライン GT-R(R32) V

Nissan Skyline GT-R (R32) V-Spec II from Legend 2 Model Car in 1:18 Scale by AUTOart

AUTOart Nissan Skyline GT-R (R32) V-Spec - Gun Grey Metallic

1/18 AUTOart Millenium NISSAN SKYLINE GT-R(R32) V-SPECⅡCrysrtal White 77345

Die Casting 1:18 Scale Nissan GTR R32 Simulation Alloy Car Model Collection Gift Ornament Souvenir Adult Toys Holiday Gift

AUTOart 1:18 Scale Nissan Skyline GTR R32 V-Spec II, Spark Silver

AUTOart 1:18 Nissan Skyline GT-R (R32) Wangan Midnight

NISSAN - SKYLINE GT-R (R32) V-SPEC II NEW ANIMATION MOVIE INITIAL D LEGEND 2 1991

NISSAN Skyline GT-R (R32) V-SPEC II / 1:18 AUTOart car model / 4k video by Auto Model Romance

ミニカーショップ ケンボックス 1/12・1/18スケール☆77345☆日産

1/18 AUTOart NISSAN SKYLINE GTR GT-R (R32) V-SPEC II TUNED VERSION

オートアート R32 スカイライン GT-R VスペックⅡ 1/18 ミニカー

NIssan Skyline GT-R (R32) V-Spec II New Initial D the Movie

Amazon.com: Skyline GT-R (R34) V-Spec II RHD (Right Hand Drive

1/18 Autoart Nissan Skyline GT-R (R32) Initial D

Crystal White Nissan Skyline GT-R R32 V-Spec II Tuned Version

AUTOart 1/18 日産 スカイライン GT-R R32-

1/18 Nissan Skyline GT-R R32V - Spec II 「 New Theater Version

Tamiya Nissan Skyline GT-R V-Spec II Sportscar Plastic Model Car

AUTOart (オートアート) コンポジットダイキャストモデル 1/18 日産

AUTOart 1/18 日産 スカイライン GT-R (R32) VスペックII: 銀の備忘録

Autoart 1:18 Nissan Gtr R32 Skyline V-Spec II Simulation Model Car

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています