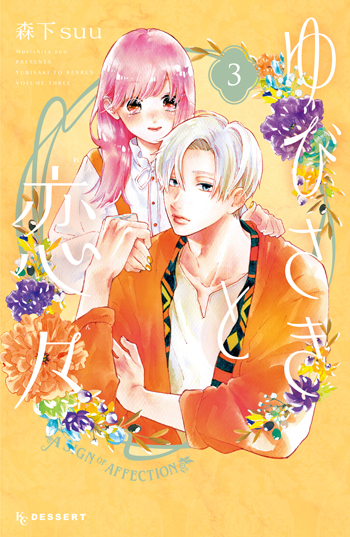

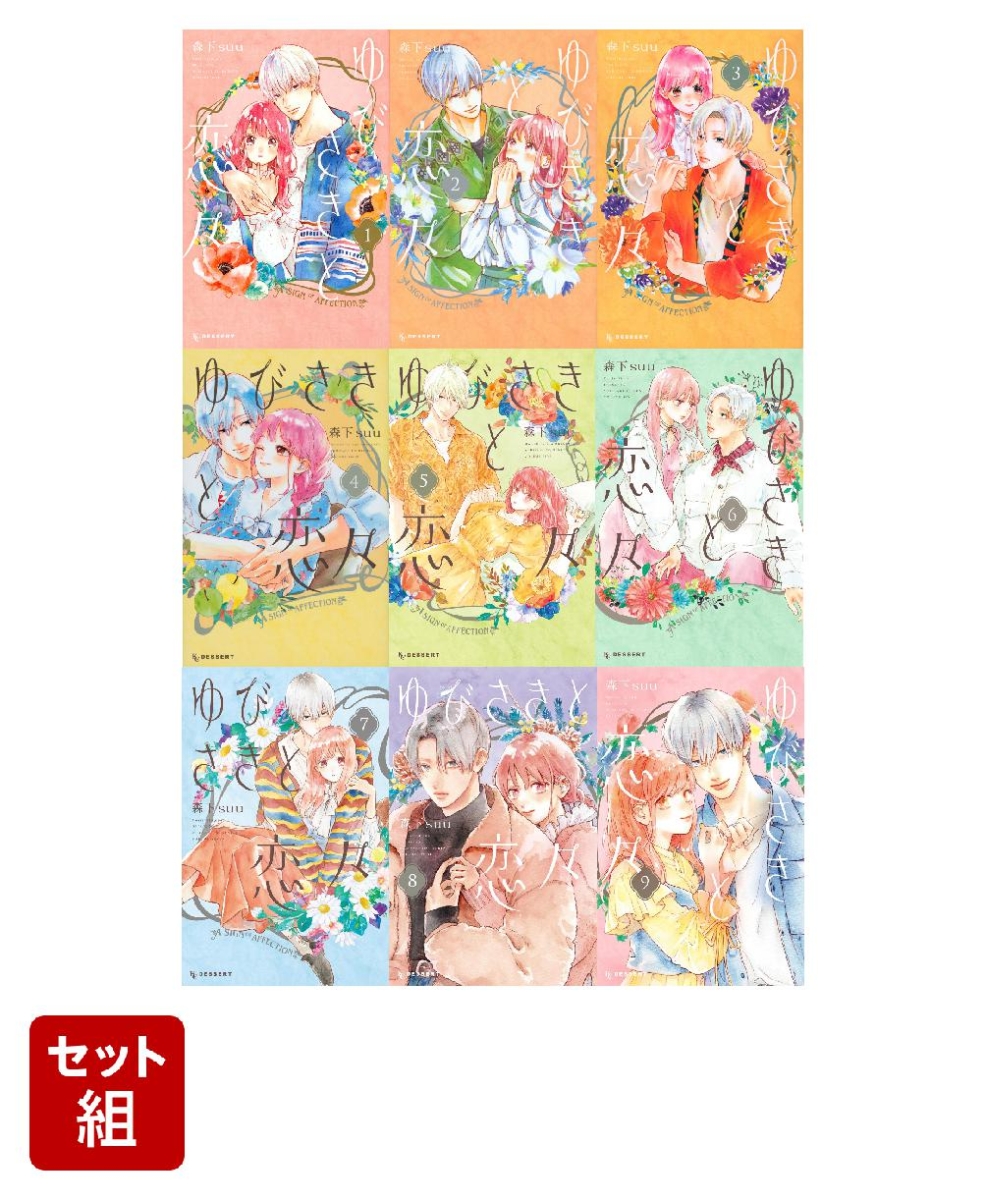

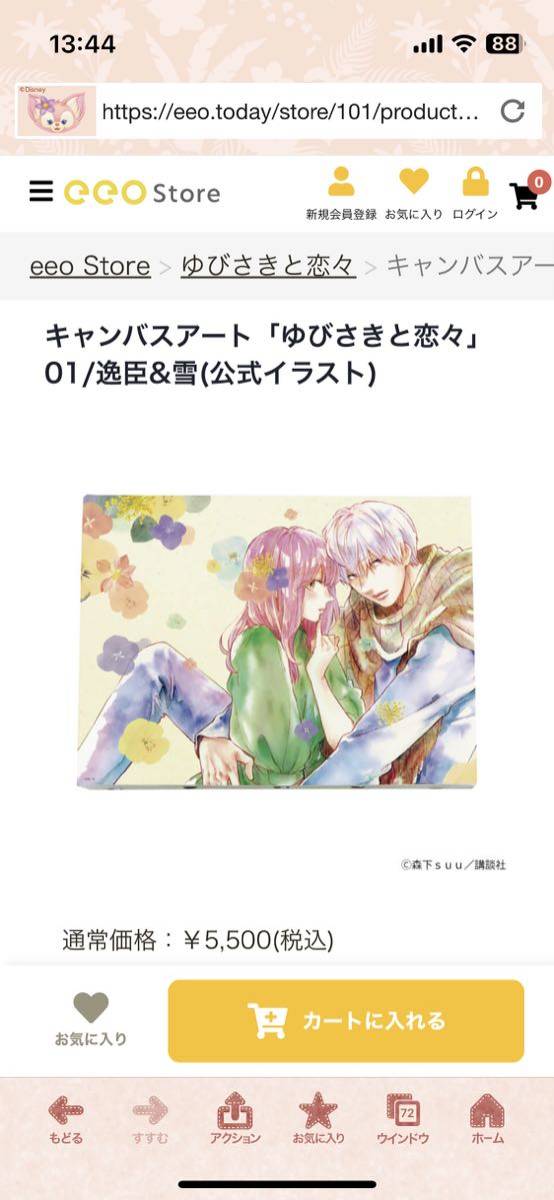

ゆびさきと恋々 1〜3 全巻初版、カラーイラストペーパー全種類、第一刷発行

(税込) 送料込み

商品の説明

「ゆびさきと恋々 1」

森下 suu

★★★メルカリや、他サイトでも、

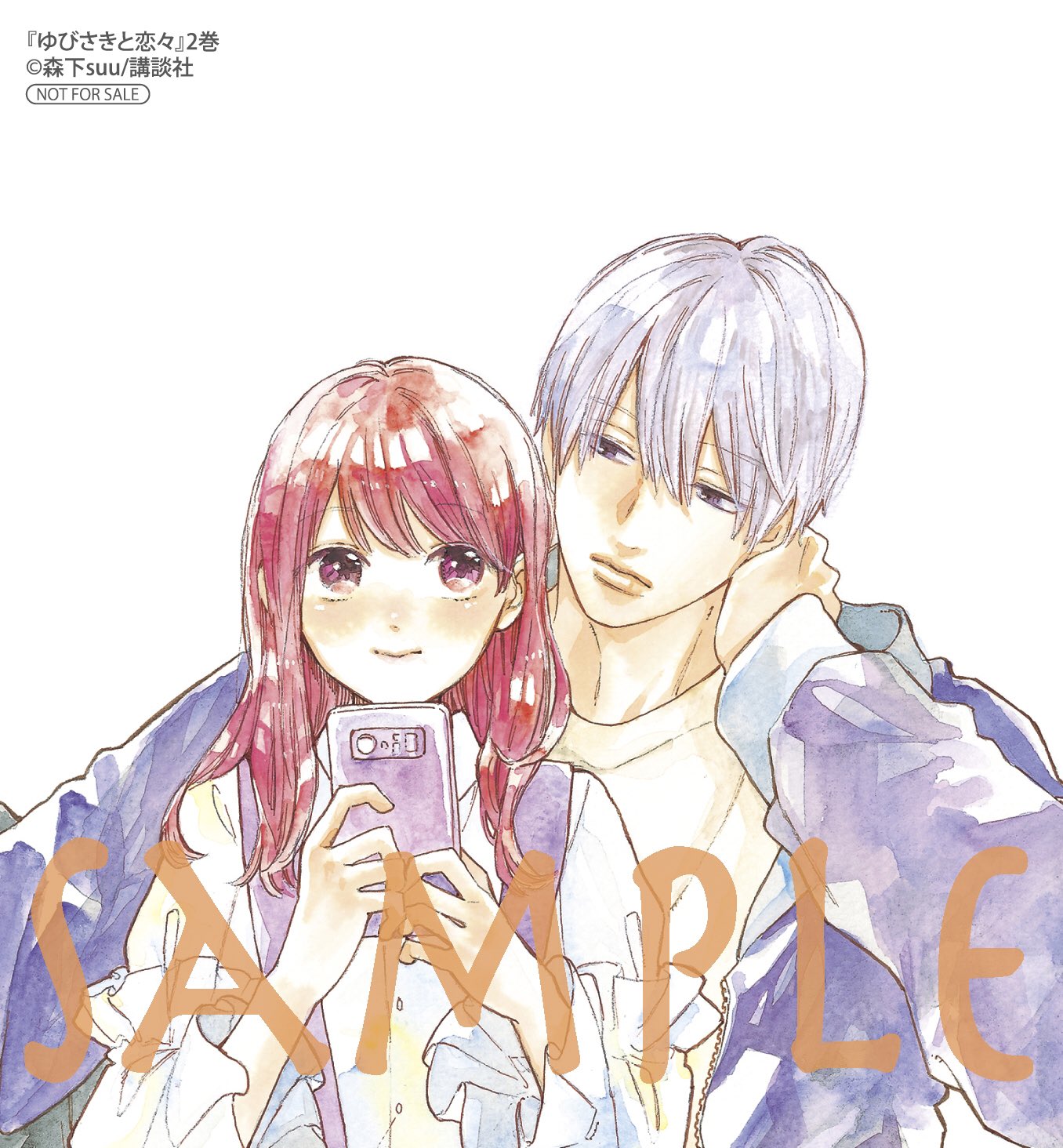

白黒コピー(※されたもの)しか販売されていませんが、カラー版が(原本)本物です★★★

※白黒ペーパーでも高値で売買されているので、お値下げは考えていません。こちらの商品が、本物です!!

「白黒コピー品の金額ではお譲り出来ません」

★★原本カラー版の特典は、

初版本ですので、

全種類コンプリートしています★★

(4巻以降は、カラー特典無し)

◯商品状態

全巻初版〜すべて第一刷発行。

初版帯 付き

講談社 公式「原本のカラーイラスト特典」(全種類)付き!!

出品画像1枚目が、発送商品のすべてです

ーーーーーー

★★★あくまでも、カラーが【本物】で、

白黒は、【複製・コピーされた】ものです。

★原本なので、今では入手出来ません。

アニメ化するので、今後さらに高騰すると思います。

ーーーーーー

経過年数は3年以上あります。

表紙カバーに軽微な折れ、擦れ、

特典は、左上にわずかな折れがあります。

大切に保管していますが、どうしても月日のあるお品物ですので、年代物へのお譲りにご理解頂ける方のご購入をお待ちしております。

※バラ売り不可。

宜しくお願い致します

#森下suu #ゆびさきと恋々初版 #ゆびさきと恋々特典 #ゆびさきと恋々カラーペーパー

#森下suu #森下_suu #本 #アニメ化

#森下suu #森下_suu #本 #コミック/コミック商品の情報

| カテゴリー | 本・音楽・ゲーム > 漫画 > 少女漫画 |

|---|---|

| 商品の状態 | 目立った傷や汚れなし |

2023年最新】ゆびさきと恋々 全巻の人気アイテム - メルカリ

2023年最新】ゆびさきと恋々 全巻の人気アイテム - メルカリ

ゆびさきと恋々(1) (デザートコミックス) | 森下suu | 少女マンガ | Kindleストア | Amazon

超特価sale開催】 ゆびさきと恋々 すべて初版、原本のカラーイラスト

2023年最新】ゆびさきと恋々 全巻の人気アイテム - メルカリ

新品]ゆびさきと恋々 (1-9巻 最新刊) 全巻セット : m1560442608 : 漫画

超特価sale開催】 ゆびさきと恋々 すべて初版、原本のカラーイラスト

講談社 - ゆびさきと恋々 1 特典ペーパーの通販 by **みずき

ゆびさきと恋々 特別版 ゆびさきと恋々 (7)特装版|森下suu|LINE マンガ

2023年最新】ゆびさきと恋々 全巻の人気アイテム - メルカリ

ハンドレタリング 2/朝日新聞出版 :BK-4023333549:bookfan - 通販

講談社 透明 少女漫画の通販 500点以上 | 講談社のエンタメ/ホビーを

ゆびさきと恋々の値段と価格推移は?|40件の売買データからゆびさきと

ゆびさきと恋々(3) - comirano.info

2023年最新】ゆびさきと恋々 全巻の人気アイテム - メルカリ

ゆびさきと恋々」扉ページ。 - 森下suu&アサダニッキの新連載が

2023年最新】ヤフオク! -恋々…の中古品・新品・未使用品一覧

超特価sale開催】 ゆびさきと恋々 すべて初版、原本のカラーイラスト

森下suu on X:

講談社 透明 少女漫画の通販 500点以上 | 講談社のエンタメ/ホビーを

2巻の些細な設定です↓ 感想たくさんありがとうございます なかなかお

ゆびさきと恋々(1) (デザートコミックス) | 森下suu | 少女

ゆびさきと恋々の値段と価格推移は?|40件の売買データからゆびさきと

楽天ブックス: ゆびさきと恋々(1) - 森下 suu - 9784065180624 : 本

デザート4月号発売日です? #ゆびさきと恋々 は7話目、表紙と巻頭カラー

特典☆ゆびさきと恋々 1~4巻☆森下suu☆カラーペーパー付き 全巻の

U900

ますむら.ひろし先生著 宮沢賢治童話集 初版帯付 2022公式店舗 38.0

2023年最新】ヤフオク! -恋々…の中古品・新品・未使用品一覧

2023年最新】ゆびさきと恋々 全巻の人気アイテム - メルカリ

特典☆ゆびさきと恋々 3巻☆森下suu☆カラーペーパー 共通ペーパー付き

講談社 - ゆびさきと恋々 1-9巻セットの通販 by ニコ's shop

ますむら.ひろし先生著 宮沢賢治童話集 初版帯付 2022公式店舗 38.0

デザート 2022年6月号 【表紙】 ゆびさきと恋々 講談社 本/雑誌 - Neowing

ゆびさきと恋々の値段と価格推移は?|40件の売買データからゆびさきと

ゆびさきと恋々(1) (デザートコミックス) | 森下suu | 少女

U900

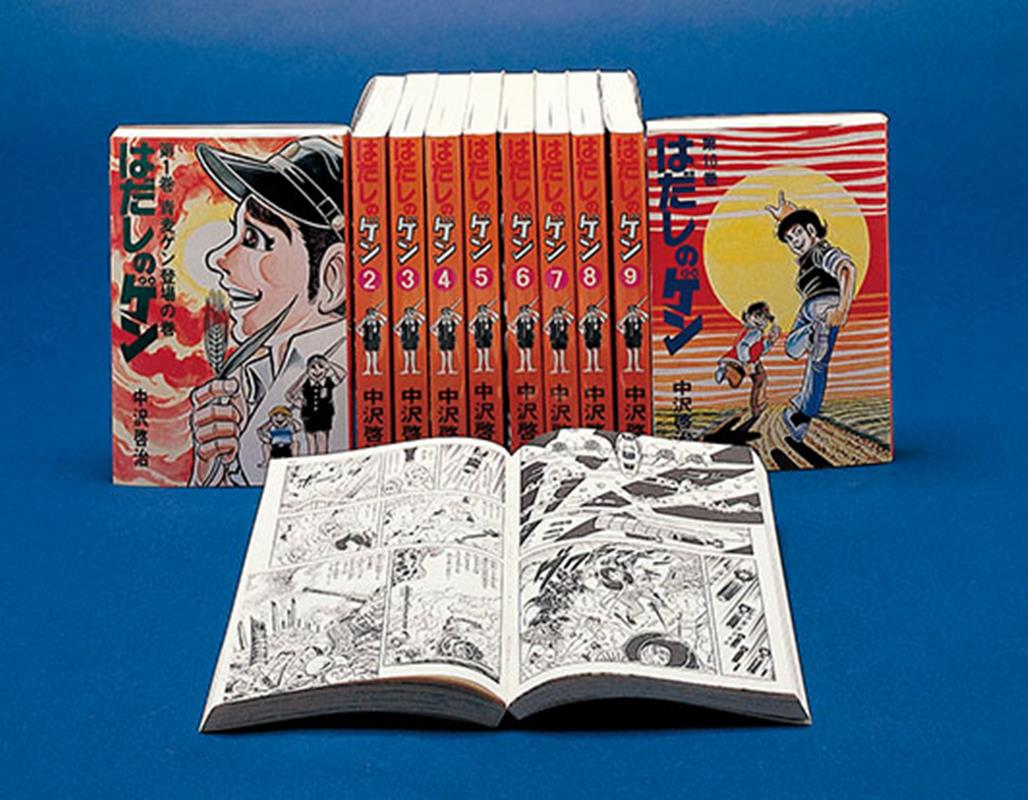

楽天ブックス: コミック版はだしのゲン(全10巻セット

【ライフisオンリーわん!】瀬戸うみこ カラーイラストミニペーパー、初回ペーパー、アニメイト特典ペーパー付き 初版

2023年最新】ゆびさきと恋々 特典の人気アイテム - メルカリ

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています